Cryptocurrency Capital Investment Firm Regulations Australia

We delve into the different types of tax cryptocurrency investors and traders are. If you are involved in acquiring or disposing of cryptocurrency you need to be aware of the tax consequences.

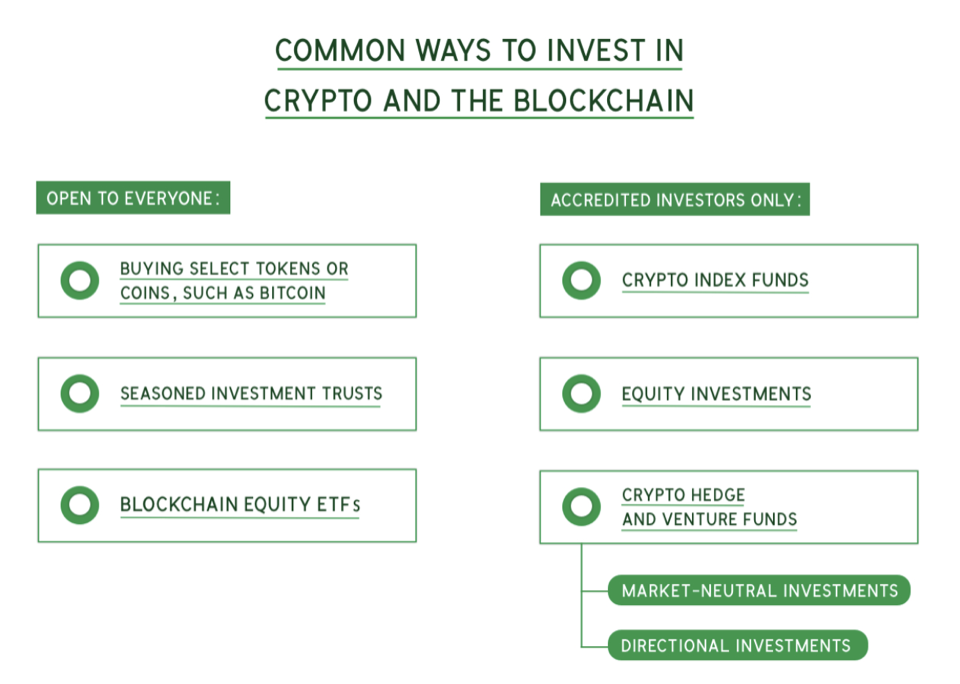

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

In Australia cryptocurrencies are viewed as digital assets and are monitored by the Australian Securities and Investments Commission ASIC.

Cryptocurrency capital investment firm regulations australia. Everybody involved in acquiring or disposing of cryptocurrency needs to keep records in relation to their cryptocurrency. Unlike most of the pure venture capital funds on this list Pantera is a hybrid hedge fund venture fund making seed investments in blockchain companies as well as investing in tokens and cryptocurrencies. By Tim Johnston June 8 2018.

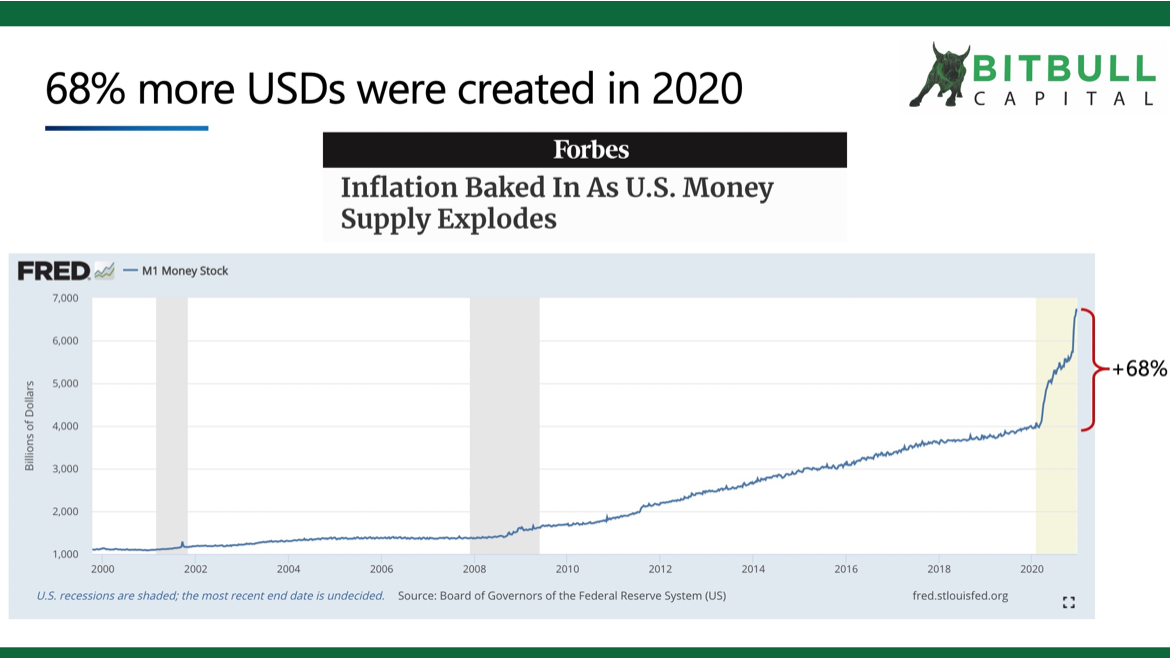

Both cryptocurrencies subjected to Capital Gains Tax and cryptocurrency exchanges called Digital Currency Businesses are legal in the country and those wishing to operate an Australian licensed cryptocurrency exchange need to operate from the country identify and verify all users and clients report all needed information to the authorities and keep records. The debt to equity ratio also provides information on the capital structure of a business the extent to which a firms capital is financed through debt. While cryptocurrency is new ish in the grand scheme of money in exchange for goods and services the tax department is not.

Total Blockchain Company Investments. The lower the positive ratio is the more solvent the business. While Australian regulators have taken a cautious stance when it comes to the use of Bitcoin and other cryptocurrencies the dynamic landscape means further regulatory changes will need to occur.

Founded in 2016 Polychain Capital offers seed-stage investment with 175 million in raised funds so far. If you hold the new cryptocurrency as an investment for 12 months or more you may be entitled to the CGT discount. In 2018 the Australian Transaction Reports and Analysis Centre AUSTRAC announced the implementation of more robust cryptocurrency exchange regulations.

As a result it has released a consultation paper to help it finalise its positions on good practices for market operators and product issuers. Similar to other markets cryptocurrency and decentralized finance DeFi regulation in Australia is currently being looked at by a mixture of regulators. What are some of the biggest challenges facing cryptocurrency investors.

When working out your capital gain the cost base of a new cryptocurrency received as a result of a chain split is zero. The Australia chapter is set out in full below. This is a solvency ratio which indicates a firms ability to pay its long-term debts.

The Reserve Bank of Australias website explains how cryptocurrency and blockchain technology works. The regulations are in place to enforce best practices for ICOs and crypto exchanges as well as crypto service providers. One of the most famous blockchain venture capital firms PolyChain Capital aims to provide its investors with extremely high returns by funding the most promising next-generation blockchain and cryptocurrency projects.

Crypto Tax Australia Guide 2021. Every Capital is Australias first retail investment fund for cryptocurrency assets. We believe that every Australian should have the opportunity to simply and securely invest in cryptocurrencies.

Changing regulatory understanding and approaches. Those crypto regulations require exchanges operating in Australia to register with AUSTRAC in compliance with the AMLCTF 2006 Part 6A Digital Currency Exchange Register. Germany In Germany the cryptocurrencies are classified by The German Federal Financial Supervisory Authority BaFin as units of account that can be used.

Award Winning Performance. These vary depending on the nature of your circumstances. A cryptocurrency unit such as a bitcoin or ether is a digital token.

These digital tokens are created from code using an encrypted string of data blocks known as a blockchain. In many cases for example cryptocurrency investments held for more than 12 months benefit from a significant capital gains tax discount. Apollo Capital has been awarded Crypto Fund Researchs Top Performing Multi-Strategy Crypto Fund for 2019.

If you hold the new cryptocurrency as an investment you will make a capital gain when you dispose of it. Cryptocurrencies are used as payment systems to execute contracts. Ultimately the future of cryptocurrency adoption in Australia relies heavily on education regarding cryptocurrency acquisition storage security use.

Value of Venture Investments in Blockchain. Blockchain Cryptocurrency Regulation 2021 covers government attitude cryptocurrency regulation sales regulation taxation money transmission anti-money laundering promotion ownership and licensing and mining insights with respect to blockchain and cryptocurrency. Crypto Fund Research maintains a database of over 800 funds worldwide.

If you are wondering if your Bitcoin or Ethereum is subject to tax obligations the short answer is yes. The Australian Securities and Investment Commission ASIC said today that cryptocurrency-based exchange-traded products ETPs aimed at retail investors pose unique features and risks that need to be recognised by their issuers. There is no dedicated legislation dealing specifically with cryptocurrency however ASIC has released whitepapers to provide regulatory guidance.

Crypto-related firms have to voluntarily abide by the standards on consumer protection and capital requirements and pay tax in the country in exchange for approval from the regulator. Cryptocurrency is classed as a financial product under the Corporations Act 2001 Cth and falls within the scope of Australias financial services regulatory regime and the jurisdiction of ASIC. Australias leading crypto asset investment firm.

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

Japanese Financial Giant Sbi Acquires Taotao Crypto Exchange Venture Capital Cryptocurrency Crypto Mining

Pin On Bitcoin Investment Strategy

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

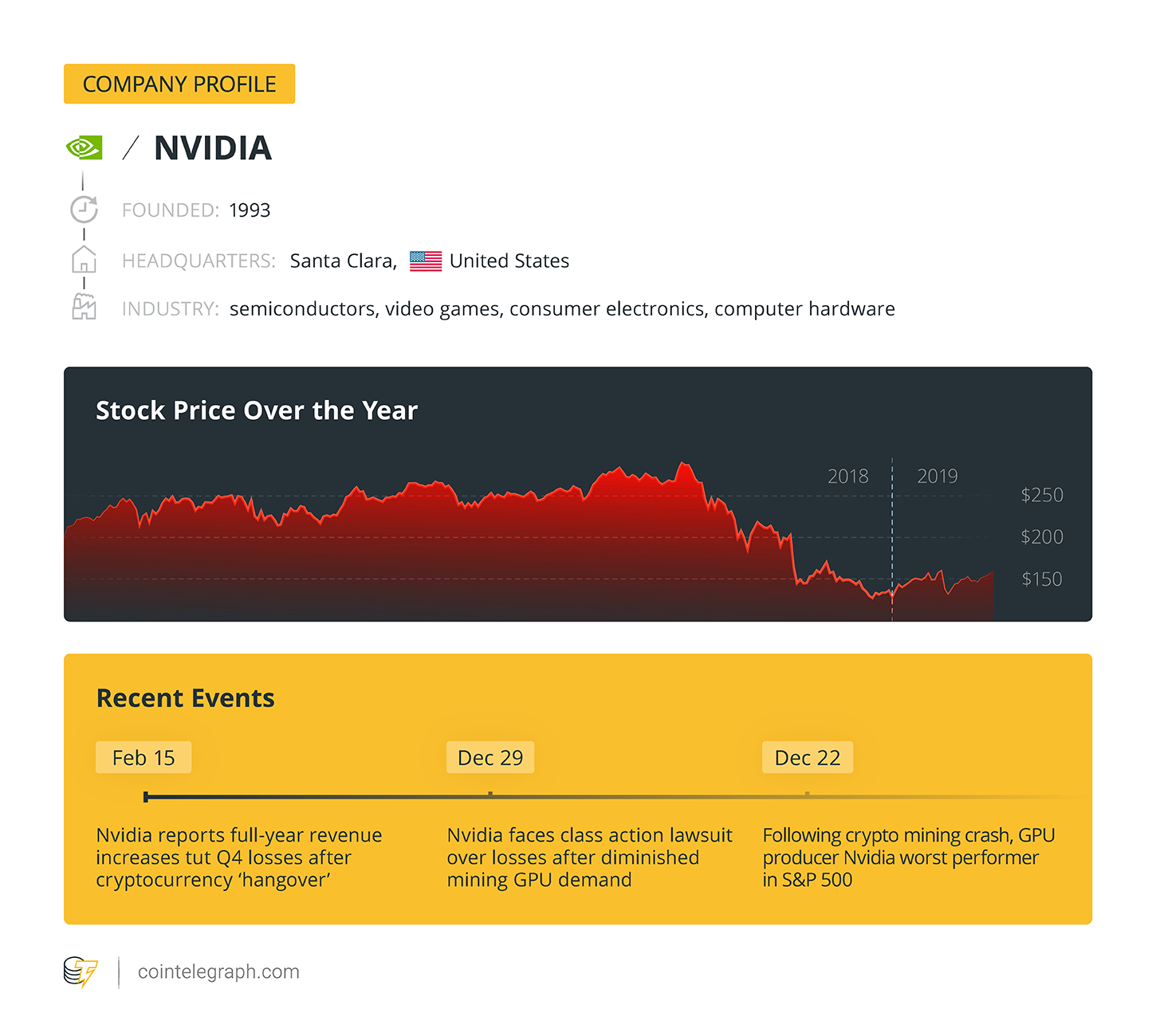

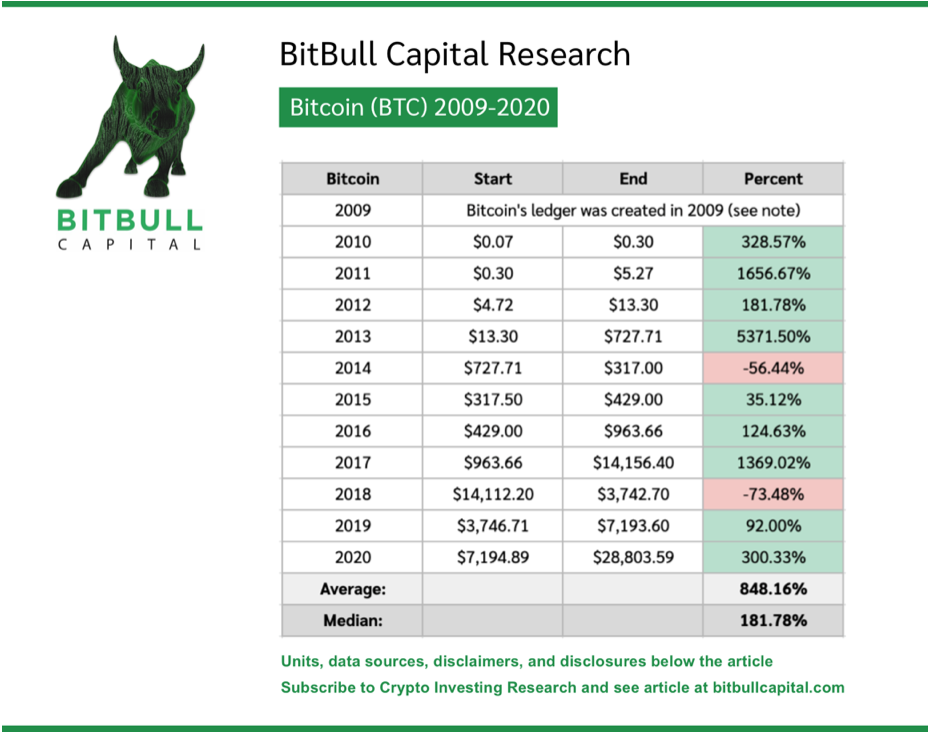

Is Bitcoin Still Making Money Bitcoin Investing Ways To Earn Money

Handshake A Sensible Root Authority Service Btcmanager Blockchain Cryptocurrency Token

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

5 Actionable Tips On Cryptotab Browser And Twitter Dollar Millionaire Cryptotrading Usa Cryptocurrency Browser Browser Extensions

Apollo Capital On Course To Become Nation S Leading Crypto Fund

Top 9 Questions About Investing In Bitcoin Blockchain And Cryptocurrencies

Tiered Personal Emergency Fund To Make You Bulletproof In 2020 Fixwillpower Bitcoin Emergency Fund Graphing

Uk Taiwanese Regulators Weigh In On Bitcoin Laundering France Ponders Icos Bitcoin Crypto News Cryptocurrency Re Money Laundering Bitcoin Best Cryptocurrency

Bitcoin Gold Wallet Buy Metal Cryptocurrency Interactive Brokers Bitcoin Futures China Cryptocurrency Neo The Mo Bitcoin Mining Cryptocurrency Bitcoin Business

Proof Of Work Is A Consensus Mechanism Used By Blockchains That Consumes Cpu Power And Electricity When T In 2021 Cryptocurrency Blockchain Cryptocurrency Blockchain

Why Invest In Cryptocurrencies Investing Investing In Cryptocurrency Cryptocurrency