Are Cryptocurrency Losses Tax Deductible Irs

For more information on capital assets capital gains and capital losses see Publication 544 Sales and Other Dispositions of Assets. Donating your crypto is tax free and deductible as long as you are donating to a registered charity.

How Is Cryptocurrency Taxed Forbes Advisor

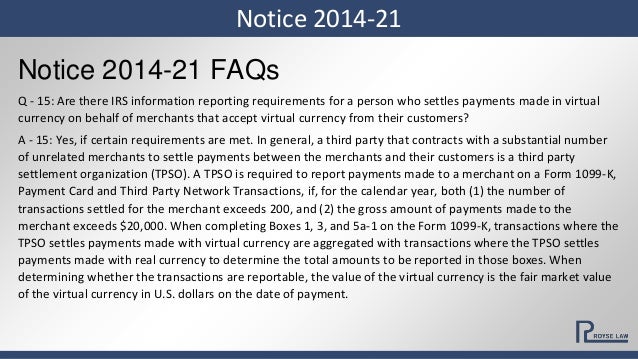

Per IRS notice 2014-21 cryptocurrencies are treated as property.

Are cryptocurrency losses tax deductible irs. Any realized income from appreciation in the value of the crypto asset is taxable as a capital gain though you can offset them against capital losses. In this guide well explore exactly what tax benefits crypto losses. If anyone sold their cryptos at a loss there might be a silver lining in this cloud since bitcoin losses are tax-deductible.

You can use crypto losses to either offset capital losses including future capital losses if applicable or to deduct up to 3k from your income. Cryptocurrencies are capital assets which means that they receive similar tax treatment to stocks. In the crypto tax space we frequently hear about taxpayers responsibilities to calculate and report their capital gains and losses on an IRS 8949 cryptocurrency tax form.

This means that when you realize losses after trading selling or otherwise disposing of your crypto your losses get deducted from other capital gains as well as ordinary income up to 3000. If your losses exceed your gains you can deduct up to 3000 from your taxable income for individual filers. The amount of your donation that is tax deductible depends on how long you have held the assets.

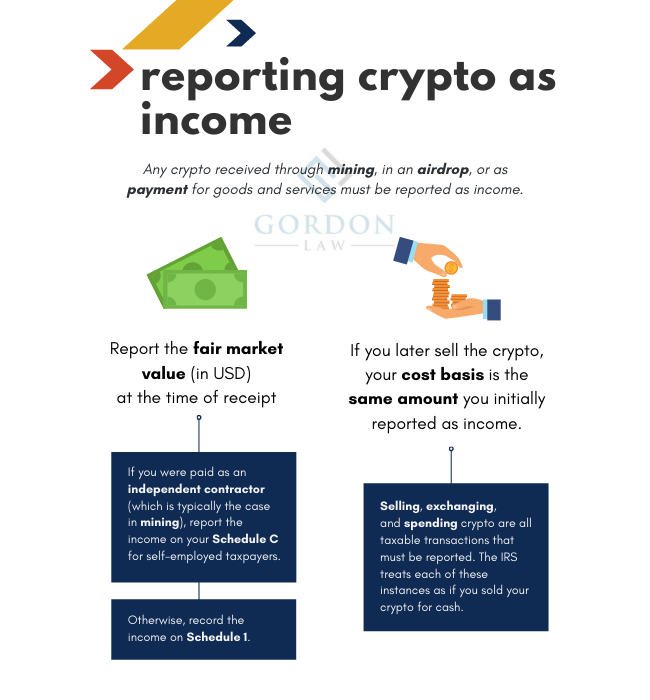

It must actually be sold in a transaction to recognize and claim a tax loss for the loss. If you sell your position at a lower price than your purchased this will create a deductible loss that you can use to reduce your capital gains in other types of assets eg. Cryptocurrencies such as bitcoin are treated as property by the IRS and they are subject to capital gains and losses rules.

The past two years have been bruising for bitcoin with the crypto falling significantly. Cryptocurrencies such as bitcoin are treated as property by the IRS and they are subject to capital gains and losses rules. When you sell virtual currency you must recognize any capital gain or loss on the sale subject to any limitations on the deductibility of capital losses.

2017 saw the dramatic rise of cryptocurrency in both pop culture and price. If your Bitcoin lost value in that time youd instead face a capital loss. The IRS requires that you report all sales of crypto since cryptocurrencies are treated as property.

They are but only if your transactions satisfy certain IRS requirements to be considered a capital loss. Donations greater than 500 have to be reported on Form 8283. Losses may be used to offset capital gains in a given tax year plus 3000 this means that any losses incurred on bitcoin and other crypto may be deductible unlike losses on your car.

The Internal Revenue Service IRS has issued new guidance for taxpayers who engage in transactions involving virtual currency including cryptocurrency. Are cryptocurrency losses tax deductible. Whenever the income tax season closes down everyone gears up for filing returns and paying taxes.

This means that when you realize losses after trading selling or otherwise disposing of your crypto your losses get deducted from other capital gains as. However the tax implications and potential deductions for mining cryptocurrency such as Bitcoin are often overlooked. Thus the true loss of cryptocurrency results in no loss for tax purposes under the current law.

For crypto held for more than 1 year you can deduct up to 30 of your Annual Gross Income. Applying a method to get a certain tax treatment for crypto transactions eg.

How To Report Cryptocurrency On Taxes Tokentax

Tutorial Crypto Taxes For Beginners

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

Irs Releases Guidance On The Tax Treatment Of Cryptocurrency Argos Kyc

Tutorial Crypto Taxes For Beginners

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Tax Guidance On Virtual Currency Cryptocurrency Transactions Virtual Currency Tax Rules Paying Taxes

Your Crypto Tax Questions Answered Lexology

Pin On 3 Independence Crypto Self Reliance Thinking

Your Crypto Tax Questions Answered Lexology

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit

Cryptocurrency Bitcoin Taxes Complete Tax Guide 2020

How To Report Cryptocurrency On Taxes Tokentax

Tax Rules For Bitcoin Are Based On How It S Being Used As An Investment Capital Gains Mining Staking Investing Investment Advisor Investment Accounts

Irs Guidance On Cryptocurrency Mining Taxes Taxbit Blog